The wealthy and investors to hold gold for safety. Initially coveted for its malleability and resistance, gold has held a prominent place in the development and stabilization of the international economy and world currency markets. It has a fascinating history to explain its persistence in the era of modern investment. Gold is known in chemistry circles as a noble metal. A noble metal resists corrosion and oxidation; all of the noble metals gold, platinum, silver, and copper precious metal have been used throughout history as currency, but gold rose to prominence based on its superior resistance to degradation. While the value of gold may spike and fall over time, it rises relatively consistently in the long run skyrocketing in times of financial and The economy is in recession and inflation.

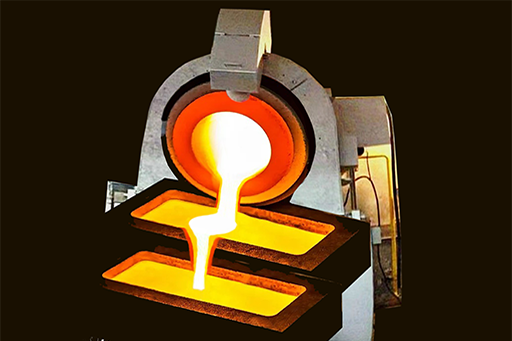

Gold Bullion

Gold Bullion historically until the present has been considered an asset reliable and secure strategy in various economic contexts. Throughout the ages, gold has proven to be an asset that not only retains value but can also offer solid economic returns in times, and most global countries use bullion gold as a reserve for central banks. Gold Bullion of Value:

Gold is widely recognized for its ability to maintain value over time. Unlike fiat currencies, which can depreciate due to inflation or political instability, gold has preserved its value throughout history, Offers economic protection against constant wealth Gold Bullion Liquidity:

Gold is a highly liquid asset that can be bought or sold easily in international markets. This liquidity ensures that asset owner can quickly access cash by selling part or all of their gold investment. Gold Bullion Global Demand:

Gold has constant demand in various sectors, including jewelry, technology, and as a reserve for central banks. This multifaceted demand ensures that gold remains relevant and valuable in different industries and economic contexts. Protection Against Inflation by Gold Bullion:

Historically, gold has proven to be an effective hedge against inflation, maintaining its value while other currencies lose purchasing power. As prices of goods and services rise, gold has tended to appreciate, offering a layer of protection for investors. Gold Bullion Accessibility:

Investing in gold bullion is accessible to a wide range of investors, as it allows investment in various quantities, from grams to kilograms, accommodating different capital levels and investment strategies. historical and economic fundamentals underscore its ability to maintain and, in many cases, have increased in value over time, to protect wealth and find gold to be a constant and stable asset.

Gold Bullion

Gold is an important component of central bank reserves because of its safety, liquidity, and return characteristics the three key investment objectives for central banks. As such, they are significant holders of gold, accounting for around a fifth of all the gold that has been mined throughout history. To help understand this sector of the gold market, reported purchases and sales along with gold as a percentage of their international reserves, to secure inflation of currency.

Most Investors Buy Gold in the First Place, and most investors largely consider gold a defensive investment. It offers protection against risks like inflation During times of currency weakening, investors flock to gold as a reliable store of value. Gold also protects against geopolitical uncertainty. Shifting winds can rattle currencies or create trade wars (or real wars). In short, investors treat gold like a hedge against risk and create a state of stability for themself.

Gold trading is known for its stability, which has made it one of the most popular investments for storing wealth. While forex traders might focus on short-term price fluctuations, most gold traders will look to take advantage of longer-term trends. Your decision about whether to buy currencies or gold will ultimately come down to your risk appetite and trading goals. Foreign exchange, known as forex, is the largest financial market in the world. Gold trading is the practice of speculating on the price of gold markets to make a profit - usually via futures, options, spot prices, and exchange-traded funds. Usually, physical gold bars or coins are not handled during the transaction; instead, they are settled in cash. There are several reasons why you might decide to trade gold, including pure speculation, or willing wanting to buy and take ownership of the physical gold. When trading gold, you don't necessarily need to hold the traditional mantra of 'buy low, sell high' as you can.

Gold Bullion